In fact, if I was to be cynical, I would say many economists who attach themselves to the mainstream, in whatever specialist area that may be, are not interested in any consistency of ideas.

Also, many were taught economics in a way that never delved deep enough into the underlying assumptions that core models embody. Perhaps the effort to understand the mathematical representation of a model took away from effort to understand the conceptual ideas within it.

Unfortunately this set of circumstances is hindering efforts at reconciliation and consistency between economic tribes. I consider this post a ceremonial attempt at reconciling theories of debt across economic tribes.

In fact there are many concepts that are easily reconcilable (capital, uncertainty, emergent properties, savings, etc) but there are unfortunate incentives against unifying the discipline.

Debt

Currently there is much concern worldwide about debt. It is widely claimed that the mainstream economic community could not see a crisis coming because it fundamentally ‘looked through’ money and debt to the real economy. And since debt, or in fact the dynamics of debt, seemed an important factors in the crisis, this was a failure of the theory.

It is easy to agree with this critique. But to really understand it we have to disentangle all parts of it, and as we will see, there is an obvious way to reconcile the mainstream with the critique.

Household example

To begin, a theory of resource allocation is right to treat debt as an internal allocation mechanism of real resources in the economy.

In a my household, for example, I can lend my wife money to treat herself a new dress today. If we were accurately keeping internal household accounts that would be a transfer from myself to her. In real terms, my consumption of resources decreases and hers increases.

Next week the debt is ‘repaid’ according to our internal accounts when my wife lends me money to take the kids to the football.

When we look at our household as an aggregate entity, our total resource consumption is unchanged by the debt, which merely represents an internal reallocation.

There were no future resources brought forward for my wife to consume. The debt did not leave a cost to our children. Even if it was never repaid, I already paid for my household’s debt with the resources I didn’t consume when I transferred purchasing power to my wife.

It surprises me that on this crucial point the core mainstream concepts are consistent with the functional finance or modern monetary theory perspective, yet there remains animosity between these groups. I have come to believe that this is mostly a result of inadequate understanding of their own conceptual apparatus by the mainstream (here’s an example of how the noisiest mainstream commentators remain confused about their own theories).

Much of the mainstream has equated 'looking through' debt to the real resources of the economic with ignoring the money creation aspect of debt altogether. This has lead to further confusion in the analysis of banking and economics generally, with the Bank of England recently having to explain the process to the economics community.

These core economic concepts are easily confused when one fails to properly understand the complete accounting of the system at all points in time. Specifically the use of overlapping generations (OLG) models can confuse more than inform, and many students come away from learning these models believing in the possibility of inter-temporal reallocations of resources.

OLG example

To labour the point, the errors made in understanding the concepts at play in debt are evident in the overlapping generations models (OLG) which is commonly applied in economics in order to understand various internal shifts in resource burdens. It can be easily misunderstood to show that debt enables resources to travel through time.

Abba Lerner made the argument I am about to make back in 1961, when he was President of the American Economic Association. He was pulling into line economists Thomas Bowen, James Buchanan, and others, on their acceptance of the political propaganda that debt can distribute burdens across time. You’ve all heard a politician claim that debts are ‘leaving a burden for our children’.

The mistake of Bowen and Buchanan arises because of their incoherent conceptual application of the OLG model. In the model they merely redefine the current generation to mean those who lend the money, and the future generation as the one who pays the money (principle and interest) back.

Let me try and represent the model as simply as possible.

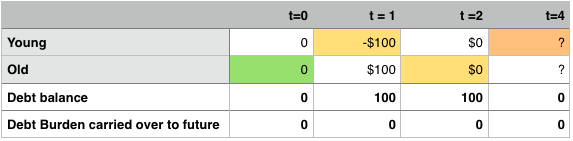

There are two generations (which are simplified into two people) alive in each time period, the ‘old’ and ‘young’. Each lives for two time periods, being young in their first time period, and old in their second. In the table below, which I will use to explain this, the coloured (and white) shaded cells are the same people, or cohort.

Starting from a no debt baseline at period zero, the first period has the old borrow $100 from the young. It doesn’t real matter whether this a new money (how we think of bank debts), direct peer-to-peer transfers, or taxes and welfare spending, the net effect is that those who borrow are able to capture a share of resources in that period.

In resource terms the young transfer $100 of resources to the old. In period two the previous old generation has died, and the previous young generation is now the old generation (yellow table cells), and there is a newly born young generation (white table cells).

The new young cohort then repays the debts, giving up $100 of resources to do so, which are transferred to the now old generation who lent the money in the previous period.

As Lerner explains, if you label the newly born young generation in period two as the ‘future generation’, which lives from period two to three (shaded white) and the cohort who originally borrowed the money in period one, who lived from period zero to one (also shaded white), the ‘present generation’, you can see how a transfer through time seems to occur.

The ‘present generation’ sees a lifetime consumption from debt of +$100, while the ‘future generation’ sees a total lifetime consumption of -$100 from this debt repayment.

Labelled in this way it seems perfectly obvious that debt burdens are being passed along. But only if we artificially conflate the creditor and debtors with 'generations', which can't be done in general.

But of course, the reality is that the resource transfers occur at each point in time, not between times. As the final row shows, in each period there is an accounting balance in resource terms between borrows and lenders. It is only because of the artificial way lenders and borrows are identified by generations, and the necessity to eliminate the debt balance in the next period that provides the result.

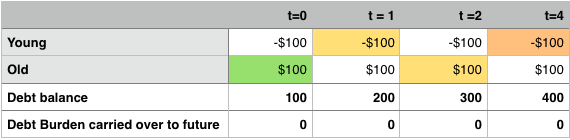

Let’s have a look at an alternative, where the same debt is incurred, but repaid (if at all) only after all generations alive upon its creation have died (and the real interest rate is zero for simplicity).

As you can see, this time it is clear that the generation born in the zero period is simply using debt to reallocate from the generation born in period one to themselves. Given the institutional power, they could of course have taxed that generation instead in order to redistribute resources. It is the same net effect.

The generational structure of the repayment of debt at some future point, however, is indeterminant. I have made this clear by labelling the period four repayment of debt with question marks, since who pays who in resource terms in that period for debt repayment is by its nature a result of all institutional resource allocations, including most importantly tax and transfer system. This is the general case.

A final illustration shows that when we consider continual debt-financed redistribution, that the redistribution problem goes away entirely, since all people receive the same redistributions at the same stages of their life. The table below show a continually debt funded reallocation from young to old, with ever increasing debt levels, but no identifiable winning or losing generation.

If you are concerned about general welfare of all people living at any point in time, then you must consider debts as internal transfers at a point in time.

Before I conclude this section, I need to again be clear that identifying winners and losers from these internal debt transfers is not at as easy as bundling all debtors and creditors together and labelling them. The complex interactions of the complete system of internal transfers means we simply cannot isolate these two groups. In fact, it may be very possible if an individual to be a borrower and lender at any point in time.

If I have just borrowed money to buy a house I am a borrower of purchasing power, which is paid for by the community at large via inflation and taxation. But of course I too am part of the community and give up resources via inflation and taxation. Understanding the balance even at an individual level is nigh impossible.

For a policy maker the whole system of transfers in a given period is all that matters, whether this occurs via taxation, transfers, debts or inflation. This is exactly what the core of macro economics says - debts are transfers in resource terms, and therefore balance out in aggregate. But somehow this is easily forgotten when it comes time to talk about policy.

Levels vs rates of change

The level of debt within an aggregate is not systematically important in terms of investment and macro economics. It is, however, important in terms of internal distribution, of which it forms a small component.

But the way in which debt levels change over time is vitally important to understanding the investment and business cycle. The reason being that debts in the private sector are typically incurred in order to finance new capital equipment and construction. By the nature of our banking and financial system, the rate of change in lending is a very good indicator of the aggregate investment occurring in the economy.

Steve Keen has repeatedly made the point is that rate of change in private debt, and its derivative (which he call acceleration of debt, being the second derivative of the debt level with respect to time), are far better indicators of the direction of the macro economics.

So while debt is an internal allocation, because our banking system generally produces debt in order to finance real new capital investment, the rate of change in the debt level can be used to understand the level of economic activity in aggregate.

This point is very subtle, but important. There is no conflict between the view that ones can look through debt in terms of its role in static allocations of resources, while at the same time understand debt dynamics as important mechanisms for financing new investment and therefore determining aggregate demand and growth.

Sadly, some economics tribal leaders have failed to acknowledge these subtleties and merely prefer to fight each other over confusing interpretations of what can be consistent ideas about debt.

Foreign debt

Finally, the mainstream economics tribe usually has divergent opinions about different forms of debt. Foreign debt gets relabelled as foreign investment and miraculously becomes a great thing. But of course this is the only type of debt where a country in aggregate is borrowing externally.

It is the type of debt most loved by economists in general, but the only one in which countries like Australia are generating future obligations to an external party.

The same rationale as before applies to foreign debts - the distribute role of levels versus the investment role of debt dynamics. Foreign debts are a resource transfer at a point in time. We can only accumulate foreign debts by running a deficit in the current account, typically by importing more goods than we export. Hence, in resource terms, we get the transfer from our imported resources.

The investment role here is far more subtle, because unlike domestic lending, there is not necessarily a close relationship between the creation of debts and new capital investment. But I won’t unpick this point any further in this post.

The point I want to make is that unlike internal debts, international debt balances are much more politically interesting. The two (in fact many) parties have different objectives, institutional constraints, and a complex web of non-monetary relationships such as military alliances, and resource interdependencies, such as reliance on either food or minerals imports.

Any questions about external debt are therefore inherently political.

One could construct a hypothetical baseline with which to compare and make judgements about external debts. This baseline would have a hypothetical market generate a relative currency value at a level that maintains a current account (and therefore capital account) balance. We only trade goods for goods in this scenario. In fact, it is a ‘no foreign debt’ scenario.

What we then need to determine is what benefits a country gains by deviating from this baseline over an extended period. We know that depressing a currency increases foreign demand for tradable goods, and therefore enables more rapid large scale investments in these sectors if there is sufficient internal organisation.

This has been a recipe for development in East Asia for the past many decades, and the subject of much political discussion and intervention (eg. the Plaza and Louvre Accords).

On the other side of the baseline we have countries like Australia that have run trade deficits and current account deficits in general for half a century. The benefits to such countries are short term gifts of relatively cheap tradable goods, at the cost of long term investment in those sectors.

Over time foreign debts have the surprising effects of generating greater reliance on each party for continued stability. In Europe we can see that ignorance of this fact is bringing down the area as a whole.

It should be obvious to any economist who understands their theoretical apparatus that the very existence of foreign debt is a sign of a political will on both sides to sustain an imbalance for their own national objectives. There is no need to continue looking at residual measures of productivity or technology or other magical explanations to understand what is ultimately a political construct.

Conclusions

Debt is a fundamental accounting feature of the monetary system. Economists used to know that they ‘looked through’ these accounts at real resources, and hence were able to see debts as merely the consequence of an internal reallocation. This lead most to believe that debt balances and their dynamics were of no interest at all.

Unfortunately, the discipline has seen a decline in the understanding of core concepts and theories, which I put down to a greater emphasis on a narrow set of mathematical techniques instead of their economic application and interpretation.

Yet there is a clear consistency between looking through debt levels as merely an account of past distributive choices, and paying very close attention to the dynamics of debt in relation to investment decisions, aggregate demand, asset prices and economic growth. Because private debts (and a portion of public debts) are, by the nature of lending processes, used for investment, their dynamics are both a signal of demand, and a driver of demand via feedbacks in the economy.

The inability to see this obvious consistency I believe is brought about by the perverse incentives in the discipline and its sociology that rewards loyalty to a tribe, and punishes attempts at reconciliation between tribes.

Currently there is much concern worldwide about debt. It is widely claimed that the mainstream economic community could not see a crisis coming because it fundamentally ‘looked through’ money and debt to the real economy. And since debt, or in fact the dynamics of debt, seemed an important factors in the crisis, this was a failure of the theory.

It is easy to agree with this critique. But to really understand it we have to disentangle all parts of it, and as we will see, there is an obvious way to reconcile the mainstream with the critique.

Household example

To begin, a theory of resource allocation is right to treat debt as an internal allocation mechanism of real resources in the economy.

In a my household, for example, I can lend my wife money to treat herself a new dress today. If we were accurately keeping internal household accounts that would be a transfer from myself to her. In real terms, my consumption of resources decreases and hers increases.

Next week the debt is ‘repaid’ according to our internal accounts when my wife lends me money to take the kids to the football.

When we look at our household as an aggregate entity, our total resource consumption is unchanged by the debt, which merely represents an internal reallocation.

There were no future resources brought forward for my wife to consume. The debt did not leave a cost to our children. Even if it was never repaid, I already paid for my household’s debt with the resources I didn’t consume when I transferred purchasing power to my wife.

It surprises me that on this crucial point the core mainstream concepts are consistent with the functional finance or modern monetary theory perspective, yet there remains animosity between these groups. I have come to believe that this is mostly a result of inadequate understanding of their own conceptual apparatus by the mainstream (here’s an example of how the noisiest mainstream commentators remain confused about their own theories).

Much of the mainstream has equated 'looking through' debt to the real resources of the economic with ignoring the money creation aspect of debt altogether. This has lead to further confusion in the analysis of banking and economics generally, with the Bank of England recently having to explain the process to the economics community.

These core economic concepts are easily confused when one fails to properly understand the complete accounting of the system at all points in time. Specifically the use of overlapping generations (OLG) models can confuse more than inform, and many students come away from learning these models believing in the possibility of inter-temporal reallocations of resources.

OLG example

To labour the point, the errors made in understanding the concepts at play in debt are evident in the overlapping generations models (OLG) which is commonly applied in economics in order to understand various internal shifts in resource burdens. It can be easily misunderstood to show that debt enables resources to travel through time.

Abba Lerner made the argument I am about to make back in 1961, when he was President of the American Economic Association. He was pulling into line economists Thomas Bowen, James Buchanan, and others, on their acceptance of the political propaganda that debt can distribute burdens across time. You’ve all heard a politician claim that debts are ‘leaving a burden for our children’.

The mistake of Bowen and Buchanan arises because of their incoherent conceptual application of the OLG model. In the model they merely redefine the current generation to mean those who lend the money, and the future generation as the one who pays the money (principle and interest) back.

Let me try and represent the model as simply as possible.

There are two generations (which are simplified into two people) alive in each time period, the ‘old’ and ‘young’. Each lives for two time periods, being young in their first time period, and old in their second. In the table below, which I will use to explain this, the coloured (and white) shaded cells are the same people, or cohort.

Starting from a no debt baseline at period zero, the first period has the old borrow $100 from the young. It doesn’t real matter whether this a new money (how we think of bank debts), direct peer-to-peer transfers, or taxes and welfare spending, the net effect is that those who borrow are able to capture a share of resources in that period.

In resource terms the young transfer $100 of resources to the old. In period two the previous old generation has died, and the previous young generation is now the old generation (yellow table cells), and there is a newly born young generation (white table cells).

The new young cohort then repays the debts, giving up $100 of resources to do so, which are transferred to the now old generation who lent the money in the previous period.

As Lerner explains, if you label the newly born young generation in period two as the ‘future generation’, which lives from period two to three (shaded white) and the cohort who originally borrowed the money in period one, who lived from period zero to one (also shaded white), the ‘present generation’, you can see how a transfer through time seems to occur.

The ‘present generation’ sees a lifetime consumption from debt of +$100, while the ‘future generation’ sees a total lifetime consumption of -$100 from this debt repayment.

Labelled in this way it seems perfectly obvious that debt burdens are being passed along. But only if we artificially conflate the creditor and debtors with 'generations', which can't be done in general.

But of course, the reality is that the resource transfers occur at each point in time, not between times. As the final row shows, in each period there is an accounting balance in resource terms between borrows and lenders. It is only because of the artificial way lenders and borrows are identified by generations, and the necessity to eliminate the debt balance in the next period that provides the result.

Let’s have a look at an alternative, where the same debt is incurred, but repaid (if at all) only after all generations alive upon its creation have died (and the real interest rate is zero for simplicity).

The generational structure of the repayment of debt at some future point, however, is indeterminant. I have made this clear by labelling the period four repayment of debt with question marks, since who pays who in resource terms in that period for debt repayment is by its nature a result of all institutional resource allocations, including most importantly tax and transfer system. This is the general case.

A final illustration shows that when we consider continual debt-financed redistribution, that the redistribution problem goes away entirely, since all people receive the same redistributions at the same stages of their life. The table below show a continually debt funded reallocation from young to old, with ever increasing debt levels, but no identifiable winning or losing generation.

If you are concerned about general welfare of all people living at any point in time, then you must consider debts as internal transfers at a point in time.

Before I conclude this section, I need to again be clear that identifying winners and losers from these internal debt transfers is not at as easy as bundling all debtors and creditors together and labelling them. The complex interactions of the complete system of internal transfers means we simply cannot isolate these two groups. In fact, it may be very possible if an individual to be a borrower and lender at any point in time.

If I have just borrowed money to buy a house I am a borrower of purchasing power, which is paid for by the community at large via inflation and taxation. But of course I too am part of the community and give up resources via inflation and taxation. Understanding the balance even at an individual level is nigh impossible.

For a policy maker the whole system of transfers in a given period is all that matters, whether this occurs via taxation, transfers, debts or inflation. This is exactly what the core of macro economics says - debts are transfers in resource terms, and therefore balance out in aggregate. But somehow this is easily forgotten when it comes time to talk about policy.

Levels vs rates of change

The level of debt within an aggregate is not systematically important in terms of investment and macro economics. It is, however, important in terms of internal distribution, of which it forms a small component.

But the way in which debt levels change over time is vitally important to understanding the investment and business cycle. The reason being that debts in the private sector are typically incurred in order to finance new capital equipment and construction. By the nature of our banking and financial system, the rate of change in lending is a very good indicator of the aggregate investment occurring in the economy.

Steve Keen has repeatedly made the point is that rate of change in private debt, and its derivative (which he call acceleration of debt, being the second derivative of the debt level with respect to time), are far better indicators of the direction of the macro economics.

So while debt is an internal allocation, because our banking system generally produces debt in order to finance real new capital investment, the rate of change in the debt level can be used to understand the level of economic activity in aggregate.

This point is very subtle, but important. There is no conflict between the view that ones can look through debt in terms of its role in static allocations of resources, while at the same time understand debt dynamics as important mechanisms for financing new investment and therefore determining aggregate demand and growth.

Sadly, some economics tribal leaders have failed to acknowledge these subtleties and merely prefer to fight each other over confusing interpretations of what can be consistent ideas about debt.

Foreign debt

Finally, the mainstream economics tribe usually has divergent opinions about different forms of debt. Foreign debt gets relabelled as foreign investment and miraculously becomes a great thing. But of course this is the only type of debt where a country in aggregate is borrowing externally.

It is the type of debt most loved by economists in general, but the only one in which countries like Australia are generating future obligations to an external party.

The same rationale as before applies to foreign debts - the distribute role of levels versus the investment role of debt dynamics. Foreign debts are a resource transfer at a point in time. We can only accumulate foreign debts by running a deficit in the current account, typically by importing more goods than we export. Hence, in resource terms, we get the transfer from our imported resources.

The investment role here is far more subtle, because unlike domestic lending, there is not necessarily a close relationship between the creation of debts and new capital investment. But I won’t unpick this point any further in this post.

The point I want to make is that unlike internal debts, international debt balances are much more politically interesting. The two (in fact many) parties have different objectives, institutional constraints, and a complex web of non-monetary relationships such as military alliances, and resource interdependencies, such as reliance on either food or minerals imports.

Any questions about external debt are therefore inherently political.

One could construct a hypothetical baseline with which to compare and make judgements about external debts. This baseline would have a hypothetical market generate a relative currency value at a level that maintains a current account (and therefore capital account) balance. We only trade goods for goods in this scenario. In fact, it is a ‘no foreign debt’ scenario.

What we then need to determine is what benefits a country gains by deviating from this baseline over an extended period. We know that depressing a currency increases foreign demand for tradable goods, and therefore enables more rapid large scale investments in these sectors if there is sufficient internal organisation.

This has been a recipe for development in East Asia for the past many decades, and the subject of much political discussion and intervention (eg. the Plaza and Louvre Accords).

On the other side of the baseline we have countries like Australia that have run trade deficits and current account deficits in general for half a century. The benefits to such countries are short term gifts of relatively cheap tradable goods, at the cost of long term investment in those sectors.

Over time foreign debts have the surprising effects of generating greater reliance on each party for continued stability. In Europe we can see that ignorance of this fact is bringing down the area as a whole.

It should be obvious to any economist who understands their theoretical apparatus that the very existence of foreign debt is a sign of a political will on both sides to sustain an imbalance for their own national objectives. There is no need to continue looking at residual measures of productivity or technology or other magical explanations to understand what is ultimately a political construct.

Conclusions

Debt is a fundamental accounting feature of the monetary system. Economists used to know that they ‘looked through’ these accounts at real resources, and hence were able to see debts as merely the consequence of an internal reallocation. This lead most to believe that debt balances and their dynamics were of no interest at all.

Unfortunately, the discipline has seen a decline in the understanding of core concepts and theories, which I put down to a greater emphasis on a narrow set of mathematical techniques instead of their economic application and interpretation.

Yet there is a clear consistency between looking through debt levels as merely an account of past distributive choices, and paying very close attention to the dynamics of debt in relation to investment decisions, aggregate demand, asset prices and economic growth. Because private debts (and a portion of public debts) are, by the nature of lending processes, used for investment, their dynamics are both a signal of demand, and a driver of demand via feedbacks in the economy.

The inability to see this obvious consistency I believe is brought about by the perverse incentives in the discipline and its sociology that rewards loyalty to a tribe, and punishes attempts at reconciliation between tribes.

Cameron: You have three examples there, in three tables.

ReplyDeleteI understand your Table 1.

Your Table 2 is incomplete. What happens in period t=3? (You left it blank.) Yet the debt balance falls from 100 in period t=2 to 0 in period t=4. Do either the young or old in period 3 get taxed to pay off the debt? What happens to their lifetime consumption as a consequence?

In your Table 3, where the debt is growing by 100 each period, what happens if the debt is growing faster than GDP? At some point, the young will be unable to afford to buy the bonds from the old. Or are you assuming, like Barro-Ricardo Equivalence, that the old bequeath their bonds to their kids as a freebie, rather than selling their bonds to the young?

General point: yes, there are two different ways of doing the accounting:

1. By time periods. Debt has no effect on the distribution of consumption across time periods (unless it is owed to foreigners, or crowds out investment, or reduced GDP via distorting taxes). Standard mainstream "we owe it to ourselves" view.

2. By cohorts. Debt can increase the lifetime consumption (or utility) of one cohort at the expense of reducing the lifetime consumption (or utility) of some future cohort (that may not yet be born).

Mainstream economists (like you ;-) ) think in terms of the first method of accounting. By time periods. Y=C+I+G+NX dominates their thinking.

But the much-ridiculed (by mainstream economists) "man in the street" may be thinking in terms of the second accounting framework. By cohorts. That second accounting framework is just as valid. And it lets you see things you can't see with only the first accounting framework.

In other words, you see a very different picture if you aggregate diagonally (the young in period t are the very same people as the old in period t+1), than if you aggregate vertically. Two different perspectives on the same data.

DeleteI disagree. The second accounting methods is completely bogus because it assumes there exists such as thing as identifiable cohorts in any meaningful sense.

DeleteI mean, am I a debtor or creditor of public debt? Is it even possible for a single person to be identified as one or the other, taking into account both their tax contribution, their use of the debt funded government investments, their activity in bond markets etc?

All the second method does is confuse the issue by labelling creditors and debtors as generations without putting any thought into the possibility of them representing any identifiable cohort of people. It slices up people and groups into debtor and creditor roles.

The reason Table 2 seems incomplete is that we have no idea who transfers resources to who. That will be a product of the total tax system, government programs and investment, ownerships of bonds and assets etc. Which is the exact same general problem with identifying who pays who when the debt is originally incurred!

You can't think of debt independently or other institutional transfers. Debt cannot be considered as anything but a small component of the tax and transfer system used to direct resources towards government-determined uses. To pretend that we can think otherwise is to misunderstand economic theory.

As you say, the man on the street thinks debts are passed on because at the individual level that is the case. But many many economists in the mainstream, I would argue over 90%, think that public debt is passed on in terms of resources. They don't correct politicians in public debate, and they perpetuate the story in their writing.

In fact I debated this very topic at an economics conference last week. I argued that the Australian government is using debt as propaganda, when we economists should know better. It is a tool for transferring resources just like taxation. While the other debaters did not tai issue (although the later did in private discussions), the audience was completely bamboozled. I spent the next day trying to explain away the OLG interpretation of who owes whom.

Hence, I put this post up to be clear not only about what the core theory of mainstream economic is (think in resource terms only), but to show that when teaching OLG we pretend that there exist identifiable debtors and creditor, and go a step further and label them generations.

So I think we agree. The only contention I guess is whether you believe identifying the debtor and creditor cohorts is meaningful. I don't.

Cameron,

Deleteit is obvious that different generations face different debt landscapes. If you borrowed to buy a house in the eighties you paid a certain interest rate, endured a certain inflation rate, enjoyed a certain wage growth rate and had your house appreciate at a certain rate.

If you buy a house now you face a different debt landscape. There are clear temporal cohorts.

There are also clear divisions within temporal cohorts, most famously and obviously being those that earn the returns of capital, and those that earn the returns of labour.

The public debt is a private asset. The taxation regime used to pay coupons on that debt affects different cohorts differently.

Debtor and creditor are simply power relations. (The most powerful can get his pencil and strike out numbers in the balance sheet.) Power directs real resources, therefore debt directs real resources, not the other way around. You cannot 'look through' debt, since debt is the most accurate representation of the political, contractual, human energy that moves commodities.

Since debt is the expression of power, debtor and creditor cohorts are the most meaningful things you can identify. Debt propaganda is used to make 'natural' and 'inevitable' the seizing of real wealth by a certain cohort. This is why the propaganda is deployed by a certain cohort. What happens if you destroy the balance sheets, like at the end of Fight Club? No real resources change, simply the claim on those resources change.

Sorry if I have just repeated the obvious, but discussing debt without power and class (cohort) seems bound to fail.

This, rather than some 'peverse incentive in the discipline', is why debt propaganda persists.

Cameron: "So I think we agree. The only contention I guess is whether you believe identifying the debtor and creditor cohorts is meaningful. I don't. "

DeleteI think it is meaningful. Take an example:

We build a new school for the kids. We have two ways of financing the school: taxes on adults; or issuing debt. Setting aside the Barro-Ricardian equivalence case (where the adults make offsetting bequests to their kids), and setting aside the Samuelson 58 case (where the debt+interest is rolled over forever), I would say that some future cohort of taxpayers is worse off under the second option (debt-finance) than under the first (tax-finance). Sure, we don't know who exactly that future cohort will be. It depends on when we raise taxes.

"But many many economists in the mainstream, I would argue over 90%, think that public debt is passed on in terms of resources."

I think I would disagree with your 90% estimate, but I only have anecdotal evidence:

When I put up my original post, disagreeing with Paul Krugman (mainstream?), saying that debt is (can be) a burden on future generations, I got a lot of pushback. Nobody said "We already know this Nick!". Robert Waldman was the only economist I can remember who had already grasped the point.

I had thought that most mainstream economists agreed with me, and I was very surprised to find they did not. So I had a helluva fight arguing against the "we owe it to ourselves" view.

As an undergraduate I was taught the "we owe it to ourselves" view. That is what I believed myself, until I read Buchanan arguing with Barro, and then re-read Abba Lerner, and spent a lot of hours figuring it out for myself.

But, I confess, I really don't know what most economists (mainstream or not) think about this question. My guess is that most of them don't think about it much at all. Or don't think clearly about it.

I believe the Functional Finance reply to the example about the school is to say that we can say very little about the decision to build a school in the absence of other information about the economy.

DeleteIf the economy is running with insufficient demand, the decision to build the school should make the future generations better off - a bigger economy, plus a school.

If we are at full employment, the school will come at the expense of another project.

The "financing" decision (taxes vs. debt vs. money creation) also depends on the cyclical position.

If you use double entry bookkeeping, when you create a debt, you also create an asset, so a lot depends on the nature of that asset and what the debt is used for.

ReplyDeleteYep.

DeleteIf you issue debt and use it to build a school, that educates the kids, the kids get an asset (their education) that offsets their future tax liability. So the kids may be better off (if it's a good school) despite having to pay higher taxes to pay off the debt.

But if you decide not to build the school, and instead use the debt to finance transfer payments to the old, the kids are worse off. (Except under Barro-Ricardo equivalence, where the old save all of the transfer payment, and give it to the kids for free.)

What if the kids highly value their old folks? Or, what if that debt means that the kids don't need to pay to support the elderly?

DeleteSteve

Steve: "Or, what if that debt means that the kids don't need to pay to support the elderly?"

DeleteThat is exactly like Barro-Ricardo Equivalence, only in reverse.

According to Barro, debt is not a burden on future generations, providing the old generation makes gifts to their kids to offset that burden. Your example is exactly like that, except the kids are making gifts to their parents, and the debt means they reduce those gifts to offset the effect.

Cameron, your example did not show the effects of aggregate internal debt because there was no interest involved and because your household only earns money from external work and only spends money on external items. It does not produce goods or services for sale between the members of the household. So the husband was able to make the small loan in cash from his savings and the wife was easily able to pay it back without interest from her savings (or her external earnings).

ReplyDeleteTo demonstrate the effects of internal debt suppose that the wife borrowed $100 @ 100% per week from the husband and that she could only repay $100 per week. Her consumption is now permanently reduced by $100 per and while the husband may now choose to spend $100 more per week on external consumption, he may also choose not do so.

Now suppose further that the wife has been cooking.for her husband. She decides that she needs to earn more money so that she can pay off the debt. She can choose to spend extra time cooking and selling frozen meals to strangers which reduces her leisure time; or she can choose to spend the same time as before but not cook for her husband which reduces the debt but also means that her husband now has to reduce his leisure time in order to cook (or to buy meals). Finally she can choose to sell meals to her husband which means that he can choose whether to buy from her or from another (cheaper?) external supplier, reducing his money available to buy non-food consumption.

So my point is that even in so simple a system as a family household, internal debt can have consequences on consumption of goods, services or leisure time once interest is levied, particularly when the level of interest, or the size of the principal makes it impossible for the borrower to quickly pay back the principal.

You've forgotten, as everybody seems to, that interest is spent. It doesn't just disappear.

DeleteIn aggregate it is spent somewhere. Interest is just profit, and the arguments against interest are the same arguments against profit.

Interest is the earnings of lenders in the same way that profit is the earnings of capitalists. That is how they earn a wage.

Derek,

ReplyDeleteSure, I simplified away from interest, but interest is merely a transfer in the opposite direction.

You are making the mistake that it is possible to identify who owes the debt to whom in aggregate.

Maybe in my household with very few people that could be possible to easily identify the parties to debt. But in a whole country is that really possible? Government creates new money to build a bridge, and I am employed constructing it. Am I a creditor to the government (yes), but and I also benefiting from the debt (yes, I am employed, and I will also use the bridge).

How do I account for all these people who are part of both sides of the ledger?

Sure, as you point out there might be incentive effects from debts. But that's true of the whole institutional system - property rights, taxes and transfers, debts, etc - and debts are just a small part of that system.

As a general point though, I disagree that the existence of a positive real interest rate changes anything about my analysis.

We could change Cameron's example to introduce a positive interest rate, but it wouldn't change the basic point. (The only difference it does make depends on whether the interest rate is greater or less than the growth rate; because if it is less than the growth rate it would be possible to rollover the debt forever, so that no future cohort would have to pay higher taxes.)

DeleteCameron: take the case of a small open economy, with a foreign debt. In this case we agree that there is a genuine liability, because we do not owe it to ourselves. But we cannot identify the particular future cohort of taxpayers who owe that liability any better than in the case of an internal debt in a closed economy. Your argument proves too much, because it would seem to imply there is no burden even in the case of an external debt.

Well actually, I make the point that the very existence of foreign debt is a political question, and hence any analysis of burdens or obligations must be a political calculation.

DeleteAgain, we can't simply pretend that there are generations that match debt obligations, and we can't pretend that the accumulation of even higher future debts is impossible.

Australia is the perfect case of the small open economy with plenty of foreign debt. We've been accumulating debts since records began, yet we haven't been asked to repay our total debt balance.

Why not?

The reason I say this is because there is no good economic reason why would a country on either side of the foreign debt equation want to reverse their obligations? It would be massively disruptive for both sides.

It would involve massive shift in relative currency values, consequently a massive shift in real production.

If Australia has a lot of investment opportunities, relative to the savings of Australians, both relative to the rest of the world, it would make sense to finance by borrowing from foreigners. And there's no reason at all why that shouldn't continue indefinitely, unless Oz runs out of investment opportunities.

DeleteThere is no borrowing from foreigners. The foreigners are saving (actually hoarding). If there is no foreign saving there can be no excess trade in a floating rate system. You have your causality the wrong way around.

DeleteIt's called 'vendor financing' and is the way that export led economies inject their own currency into their own economy. Via bank led swap processes.

At a real cost to that country of exports that they could have consumed themselves if they were slightly more enlightened in the domestic circulation department.