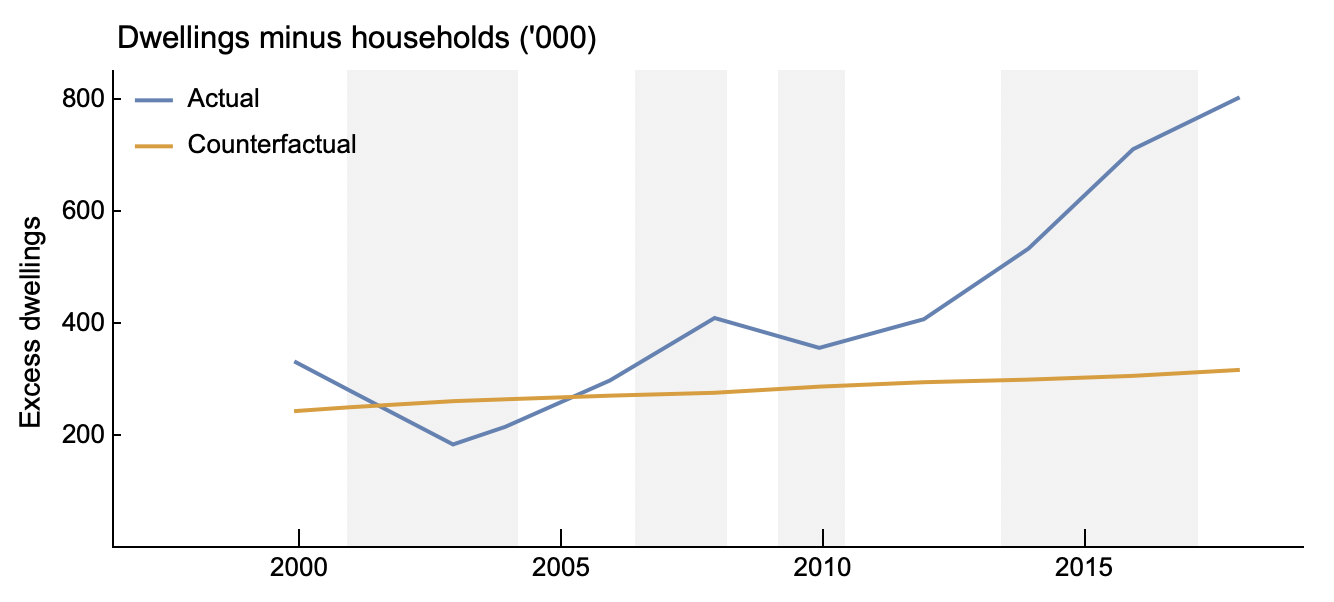

Australian data shows that the number of residential dwellings has grown faster than the number of households for the past decade, indicating a substantial rise in the proportion of empty homes. This phenomenon has been a broad one, experienced in cities such as Sydney, Vancouver, and Toronto. Here are some of my previous thoughts on the topic.

The resolution to this puzzle is as follows. Housing is an asset, and in asset markets there is a trade-off between liquidity and returns. A vacant home is a more liquid asset than an occupied home. Timing a sale is easier, the sale is faster, and it is likely to result in a higher price when vacant. When capital gains are a large proportion of the total return, and capturing this return requires timing the market because of price variability, the value to liquidity from vacancy can be high.

In short, when yields are low and prices high and variable, the benefits to vacancy are high.

Here’s an example. In Scenarios A and B the total asset return to housing is 10%. But in Scenario A the price is high and yields are low. Here, leaving the property vacant forgoes only a quarter of the total return from the asset. If prices are variable in this Scenario, then timing a sale becomes an important factor for earning the capital gains. Hence, the liquidity from vacancy has a large benefit.

In Scenario B the price is low, as the rental yield is 7.5% of the price. Capital gains are also low at 2.5%. In this low price, low capital gain, scenario, keeping the property vacant requires giving up three-quarters of the total return. The benefits from doing so are limited since capital gains are low, and hence less variable.

So there is an economic logic behind the puzzle of high prices and high vacancy, and it stems from the fact that housing is an asset as well as a consumption good. But there is also a criminal logic. Much of the vacant housing in Australia (and probably Canada and a few other locations) is due to money laundering. There are no checks on the source of finance for home purchases and no checks on who the ultimate beneficiaries are in the ownership structure. You can buy a home in a trust or company name, and the identity of the trustees and the company owners need not be disclosed. If you then also do not earn rental income, the corporate structure is protected from scrutiny by tax authorities. Housing is a great way to hide ill-gotten gains.

The criminal logic and economic logic are closely aligned. When most of the return to housing comes from capital gains it makes housing a more attractive place to hide money as three-quarters of the total return can still be had. But when most of the return comes from rent it is much less attractive — and it may require corporate disclosure due to local incomes warranting taxation.

Finally, some new data

On another note, new data from the Australian Bureau of Statistics came out recently, filling one of the holes in the housing data landscape — the share of lending to investors that is directed towards purchasing or building new homes.

This data helps to answer questions about the economic value of new credit in the economy, the real economic effects of monetary policy, and more. In standard economic thinking, low interest rates make borrowing to invest in new buildings and equipment more viable. Because standard economic models do not include secondary markets, the effect on the trade of existing assets is mostly ignored. Yet we can see that the majority of home purchases are simply trades of existing housing, and hence are a key mechanism through which low interest rates mostly cause higher prices without having much effect on new construction.

As you can see in those few months of investor data, investor lending is not substantially more biased toward new housing than lending for owner-occupiers. For investors, 24% of loans have been for new housing in the past few months, just as 24% of loans to owner-occupiers have been.

The main difference seems to be that the typical existing home bought by owner-occupiers is more expensive than the typical new home, whereas for investors the mean value of lending to both is the same.

The resolution to this puzzle is as follows. Housing is an asset, and in asset markets there is a trade-off between liquidity and returns. A vacant home is a more liquid asset than an occupied home. Timing a sale is easier, the sale is faster, and it is likely to result in a higher price when vacant. When capital gains are a large proportion of the total return, and capturing this return requires timing the market because of price variability, the value to liquidity from vacancy can be high.

In short, when yields are low and prices high and variable, the benefits to vacancy are high.

Here’s an example. In Scenarios A and B the total asset return to housing is 10%. But in Scenario A the price is high and yields are low. Here, leaving the property vacant forgoes only a quarter of the total return from the asset. If prices are variable in this Scenario, then timing a sale becomes an important factor for earning the capital gains. Hence, the liquidity from vacancy has a large benefit.

| Return | Cap. gains | Rent | |

| Scenario A | 10% | 7.5% | 2.5% |

| Scenario B | 10% | 2.5% | 7.5% |

In Scenario B the price is low, as the rental yield is 7.5% of the price. Capital gains are also low at 2.5%. In this low price, low capital gain, scenario, keeping the property vacant requires giving up three-quarters of the total return. The benefits from doing so are limited since capital gains are low, and hence less variable.

So there is an economic logic behind the puzzle of high prices and high vacancy, and it stems from the fact that housing is an asset as well as a consumption good. But there is also a criminal logic. Much of the vacant housing in Australia (and probably Canada and a few other locations) is due to money laundering. There are no checks on the source of finance for home purchases and no checks on who the ultimate beneficiaries are in the ownership structure. You can buy a home in a trust or company name, and the identity of the trustees and the company owners need not be disclosed. If you then also do not earn rental income, the corporate structure is protected from scrutiny by tax authorities. Housing is a great way to hide ill-gotten gains.

The criminal logic and economic logic are closely aligned. When most of the return to housing comes from capital gains it makes housing a more attractive place to hide money as three-quarters of the total return can still be had. But when most of the return comes from rent it is much less attractive — and it may require corporate disclosure due to local incomes warranting taxation.

Finally, some new data

On another note, new data from the Australian Bureau of Statistics came out recently, filling one of the holes in the housing data landscape — the share of lending to investors that is directed towards purchasing or building new homes.

This data helps to answer questions about the economic value of new credit in the economy, the real economic effects of monetary policy, and more. In standard economic thinking, low interest rates make borrowing to invest in new buildings and equipment more viable. Because standard economic models do not include secondary markets, the effect on the trade of existing assets is mostly ignored. Yet we can see that the majority of home purchases are simply trades of existing housing, and hence are a key mechanism through which low interest rates mostly cause higher prices without having much effect on new construction.

As you can see in those few months of investor data, investor lending is not substantially more biased toward new housing than lending for owner-occupiers. For investors, 24% of loans have been for new housing in the past few months, just as 24% of loans to owner-occupiers have been.

The main difference seems to be that the typical existing home bought by owner-occupiers is more expensive than the typical new home, whereas for investors the mean value of lending to both is the same.