When news of the first dozen COVID cases was broadcast my Mum panicked. Facts could not persuade her about the true scale of the disease. It didn’t matter what proportion of deaths COVID was responsible for, nor the chance of even more deaths from our policy reaction. It was “bad news” and “something must be done”.

So when we gather for Christmas the conversation will not drift towards this elephant in the room. The implications and outcomes of the biggest world event for decades will go unspoken when we normally reflect on the major events of the year.

COVID has introduced another tear in an already torn social fabric. No longer can we freely discuss the merits of our policy reaction, the cost of it, the human toll. You are a COVID denier or a COVID believer. There is nothing else.

I can predict that you, dear reader, are already judging me based upon the previous 140 words. That is the power of a story in human society; especially a scary one. The COVID story has changed your perception. It has changed my own conversations with my own family. The biggest effect of all—one that will be felt for years—is that this story will cover up the exorbitant exercise of political power for the benefit of political mates. It is through this mechanism that the story of COVID, not the reality of it, will cost the world dearly.

Stories and power

One of the crucial ingredients to exercising political power in favour of one’s own network is having a good cover story. One of my big mistakes in understanding the global response to COVID early on was to underestimate the power of the story. I predicted that the huge economic and health cost of locking down human society would be obvious within the first months of it occurring. I thought the story would change so that we would avoid the huge health costs of lockdowns.What is truly scary is that the enormous costs of lockdowns are now obvious, but the lockdowns continue. Most frightening of all, most people want them!

Lockdowns are now a politically expedient response to a story that has been more infectious than COVID itself.

Partly, the use of lockdowns continues because it mostly affects the working class. The elites are insulated from this policy, at least to a degree. The main countervailing force is the small degree to which lockdowns apply to the political elite. Although politicians gain power with lockdowns and aggressive strong-man responses to COVID, like border closures, they must also personally suffer some of the consequences. That is why many elites flaunt their own rules, revealing that they are not creating and enforcing lockdown rules because they believe them to be effective, but because they understand the politics.

Harnessing the power of the scariest story yet invented

The obvious next move for the political elites is to capitalise on the virulent COVID story by transforming it into a justification for more substantial political power plays.Normal oversight of major economic decisions is now almost non-existent, meaning favours for mates can be slipped into COVID-response policy decisions such as cash grants and subsidies to businesses who are unaffected, or rezoning and dodgy land deals. Indeed, the usual financial engineering of the central banks in response to economic shocks is mostly a giveaway in terms of insuring the risk of financial corporations.

Since first writing the above sentences the US passed the COVID stimulus bill, a monster of a document bundled together with various appropriations that seems to be written by lobbyists and contains the exact giveaways and law changes that further consolidate power.

Those who fuelled the fear should be ashamed. This was the inevitable result. Does fear ever provide the environment for the dilution of power and the sharing of wealth and prosperity? No.

2021 predictions

Note: These were first written on 21st November 2020. Some updated comments are added.- News media and big tech need to sell advertising, and fear sells. They will publish any story that is bad. Even vaccine news will have headlines like “The vaccine is 90% effective, but there’s a hidden catch.” Other routine medical and health data will be linked to COVID and made newsworthy to capitalise on the fear story.

- Many useful idiots in cushy jobs desk jobs have found life to be better with COVID. Because of this, they will be subconsciously motivated to find reasons to keep the new economic order of extensive control over the lives of others. Keep an eye out for that.

- New unrelated reasons to continue to be scared will emerge. The virus will mutate, and when the next strain arrives, the media will unleash fear-mongering headlines. Those in the game will promote it. When there are vaccine side effects, these too will be excessively reported. (Note that I wrote the previous sentences a month BEFORE the UK mutation and any vaccination approvals.)

- Rebuilding the economy will be the cover story for huge giveaways to mates. It already has been in many ways, with untargeted cash programs, and fast-tracked planning approvals, and more. These will continue into 2021.

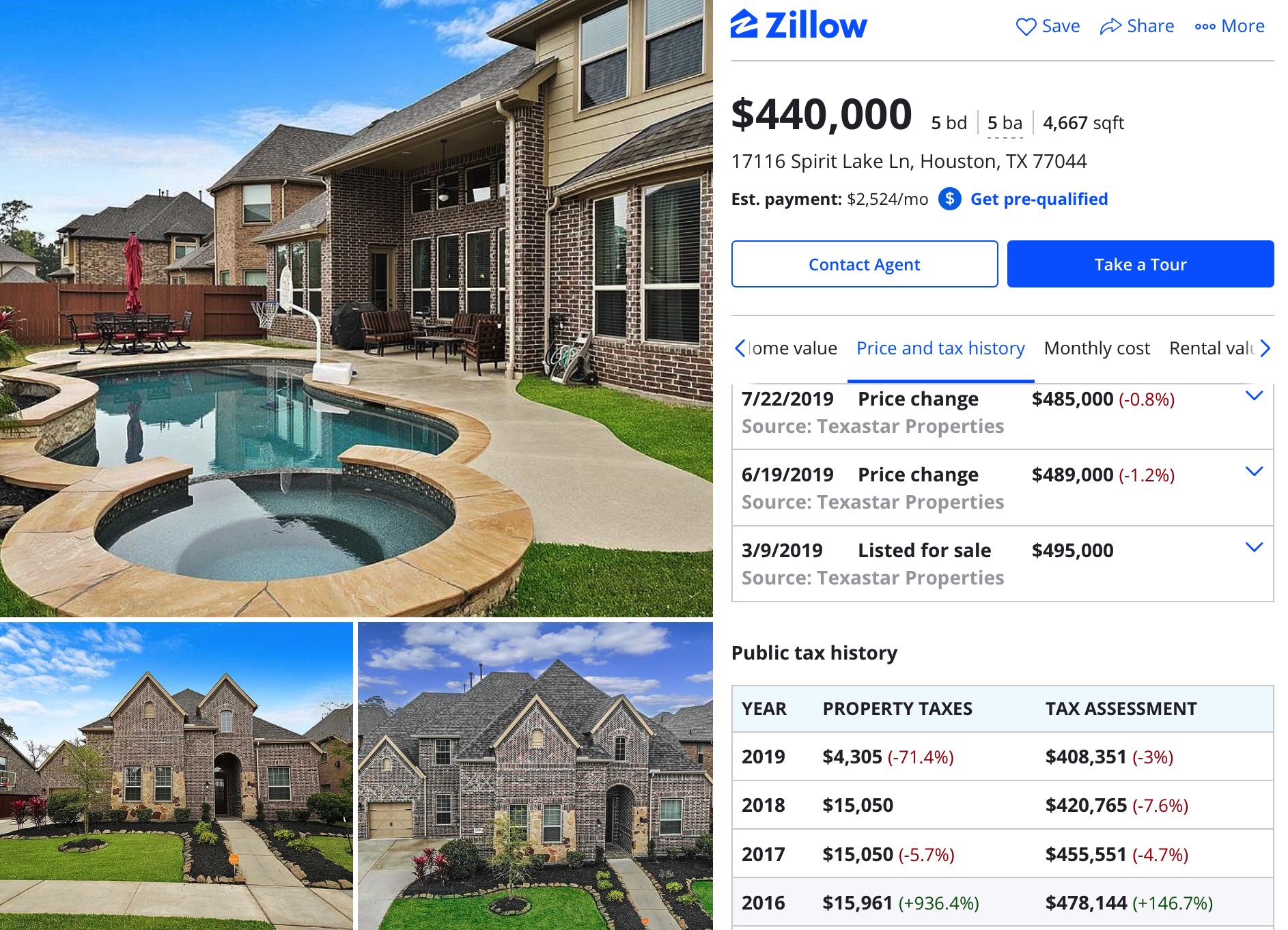

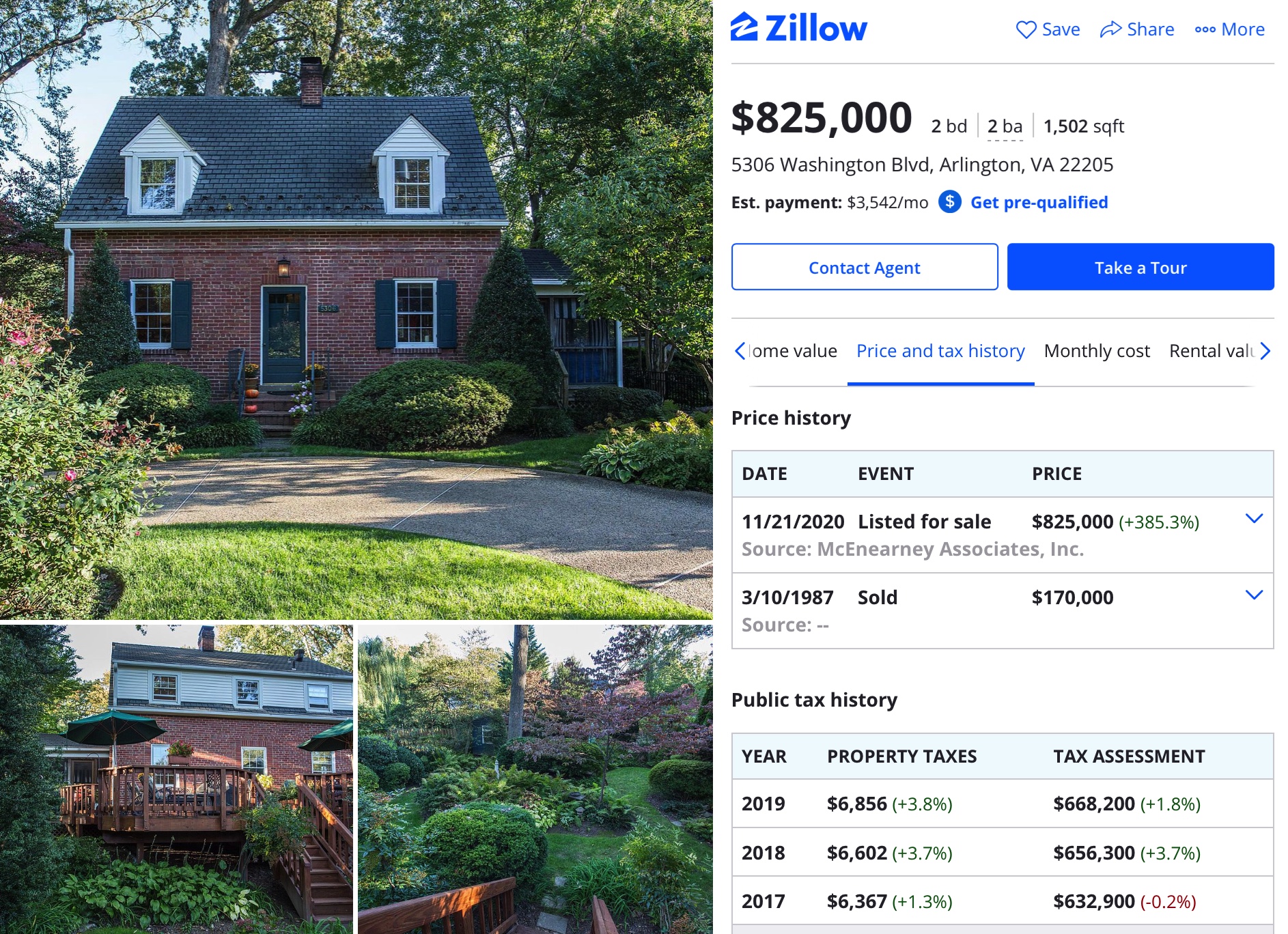

- The result of this will be a rapid economic recovery. Lockdowns will mutate into sheer political theatre and behaviour policing, with limited effects on most economic production. As these lockdowns pass, macroeconomic performance will be supercharged by the huge fiscal response seen in many countries. The housing bubbles of the UK, US, Canada and Australia will continue for a few more years.

- The battle of writing the history of 2020 will be fierce. Mainstream censorship of voices that reveal how irrational and costly the policy panic was in terms of human lives and livelihoods will continue. Sensible analysis will be shut out of social media distribution channels and even out of universities where debates and analysis are expected to take place. Technology companies have a huge incentive to police this official story because of benefits to them from the world now relying on them to an unimaginable degree.

What are your thoughts? Just remember, the truth doesn’t matter. All major institutions will have to conform to the narrative that gets written by the powerful. As I have said before, no one in power will ever want a cost-benefit analysis of their policy choices—what is the incentive to prove yourself an idiot to the world? If anything, there will be some reports written that have obviously implausible counterfactuals and these will become the standard reference point for the official writing of the history of 2020. The story and the fear will live on through these. It will be decades before the true lessons are learnt. Such is the power of the story.