There is a major flaw in the idea that high prices stimulate more housing supply. It is that high price growth itself decreases the willingness of landowners to supply land for housing.

Supply and demand (AKA Static Production Theory, or SPT)

“If we want to create widespread affordability, so that anyone can walk into a real estate office and rent something reasonable, then we must confront the laws of supply and demand.”

So

says Ed Glaeser, the highest profile urban economist of this century. He has forged a career from restating this

conventional wisdom, and now major national governments and institutions, including the Reserve Bank of Australia, generally

prescribe to this view.

Underlying this view is a single-period, asset-free, model of the world where higher prices induce more supply of housing. New housing is a simple production process that combines land and construction inputs. As long as the price of a home exceeds the input costs of land and construction, each of which is determined by their own independent markets, profit maximisation says that these homes will be immediately produced.

In the notation, and in terms of annual flows, the profit for any new home is the rent minus the interest on input costs,

π = rent − (land + construction) x interest rate

or

π = r − (L + c) i

where L and c are the land and construction input costs.

In the equilibrium, all currently profitable development options have been taken up and there is no further new supply. Additional new housing (a change in the equilibrium stock) arises when the demand curve shifts enough for marginally unprofitable development options to become profitable and get taken up. This moves the market to a new equilibrium with more dwellings supplying residential accommodation in the market, and where the new equilibrium price depends on the shape of the supply curve.

As long as r > (L + c) i, new housing will be supplied.

Because of the durable nature of homes, the otherwise standard upward-sloping supply curve

is kinked at the current price and stock of housing. The vertical portion of the curve below the kink reflects the willingness to supply existing homes to the market at a price below cost (a negative profit) in order to minimise losses on sunk investments in the event of a negative demand shock. This is shown in the figure below.

The slope of the supply curve above the kink is thought to arise from a combination of regulatory and geographic constraints that mean that the cost of building new homes is higher than it was for existing homes. As

Glaeser et al. explain, costs “depend on the city size, reflecting community opposition to development as density levels increase.” If regulatory costs involved with new housing can be reduced, such as by lowering impact fees or relaxing density restrictions that force each dwelling to use more land, then it will create more profitable development options that can be immediately taken up as well as more marginally profitable ones that can be taken up after small price increases, on net flattening this part of the supply curve, or ‘elastifying supply’.

In panel (b) of the above figure we see how the model is used to describe the case of legislative or geographic constraints. Because there are a finite number of locations where homes can be produced below current prices, the stock can only increase when prices rise and these new higher-cost locations become profitable. This can be due to any constraint, such as planning regulations or natural geography.

Implicit in this static production theory (SPT) is that costs are additive. The market price of undeveloped land is set in one distinct market, construction prices are set in another distinct market, and to supply new housing requires simply combining both inputs.

Key problems with the SPT model

Inputs to housing are themselves assets

The first problem is that new housing supply is not a production decision, but a capital allocation decision. The question is not whether the price of housing exceeds the input costs. The question is why should I take my land and financial capital inputs and combine them into a new home? The returns to both the home and the capital inputs must be the key variables in the housing supply decision.

This problem is quite obvious when we think about the housing supply condition for SPT, which is never met in Australia. Housing rents almost never exceed the interest on input costs. Only if we treat housing as an asset can we make sense of the observed market behaviour.

Poor description of the market

The model is pretty bad at describing or predicting housing market cycles. Ed Glaeser

himself noted that the model was not so useful — “the fact that highly elastic places had price booms is one of the strange facts about the recent price explosion”.

Land prices are set by magic

Appraisers and valuers view the price of vacant land as being directly determined by the value in its highest and best use, such as a residential subdivision, minus the cost of transforming it into that use. Rather than land and construction costs being additive, the valuer’s view is the reverse; land values are determined as the residual of the highest use value minus construction costs.

But without the additive cost assumption, this static production theory of supply falls apart. Home prices minus construction costs would always equal the value (cost) of land by definition, and the supply curve would lose all meaning. The implied story of how land prices are set in this model is that they are simply set by the magic of some other market that exists, but that is unrelated to the housing market itself.

A better model (Balance Sheet Dynamic Theory - BSDT)

All we need to do to improve our understanding of housing supply is incorporate into our model the fact that housing is an asset, and that building new housing is a capital reallocation away from cash and undeveloped land.

In my balance sheet dynamics theory (BSDT) landowners are rational agents making capital allocation decisions to maximise the rate of growth in the value of the total balance sheet.

Rather than housing being a new product made whenever its price exceeds its production cost, new housing is a balance sheet reallocation of land and financial capital, each of which are already earning a return.

That forgone rate of return is the opportunity cost of housing development. In this perspective, new housing is only produced when the rate of return on housing (its “return price”) exceeds the rate of return on the inputs of undeveloped land and cash (its “return cost”) to generate a “return profit”. If the rate of return on capital inputs is higher than on housing, then reallocating this capital to produce new housing reduces the growth rate of the balance sheet and it is therefore uneconomical.

Notice that price levels do not enter this assessment at all, only returns.

In BSDT the production cost of new homes does not arise from the addition of independently determined land and construction cost inputs. Instead, new housing costs at any point in time are always equal to the home price because, at the time of development, land values are determined by the residual of home prices minus construction costs (as in the appraiser's, or valuer's, view of land price determination).

This residual market-determined value of undeveloped land reflects the nature of land as a perpetual development option. But this real option characteristic of land has another effect.

Because of the flexibility in the scale of development, the price of undeveloped land does not merely track home prices but moves more than proportionally to account for the fact that higher home prices also justify higher density uses, and vice-versa. Thus, committing undeveloped land to an irreversible residential development comes at a “rate of return cost” of this price growth premium of undeveloped land.

The rate of return problem of housing supply

Three returns are relevant for understanding housing supply incentives in the BSDT; the total returns to housing, land, and cash respectively at a particular time for an amount of each input necessary to supply a single new home.

For housing, the total return is the sum of the value gain and the current rental return such that RH = Ṗ + rH where Ṗ is the change in home prices, and rH is the net rent for a representative home.

For cash, the total return, RC, is the nominal interest rate, i, multiplied by the construction cost of a home, c.

For land undeveloped, the total return is the sum the value gain plus any rents from lower-value uses, rL. Since land prices are the residual of home price minus construction costs, this means that the value gain for undeveloped land includes the price change of housing, Ṗ (assuming fixed construction costs).

But it also includes the change in the option value because the optimal density of a subdivision also changes with home prices, which we call the option premium and denote ω.

For example, a site that is currently optimally subdivided into 6 lots might be optimally subdivided into 8 slightly smaller lots if home prices in the area increase from $300,000 to $350,000 (such as the example subdivisions in the figure below).

Instead of a return due to this price growth being $300,000 (6 x 50,000), the return now includes the full value of two additional lots. As long as the price effect of subdividing into smaller lots is less than proportional to the size decrease of each lot, the total return will be higher than the home price growth for a fixed number of lots alone.

In this example, as long as the smaller lots exceed $262,500 each, the total return to land exceeds the home price growth of six lots. If we take the case where the price of the eight smaller lots is $280,000 each, then the return from price growth alone for the previously optimal six lots is $300,000, and the additional return from the option premium is $140,000 (280,000 x 8 — 350,000 x 6) to give a total return from capital gains to this undeveloped land of $440,000. Here ω=0.47.

In the notation, the return to land is RL = Ṗ + ωṖ + rL.

The housing supply problem

We can now express the gains from supplying housing in terms of the effect of on returns from shifting land and cash into housing, or RH− (RL + RC). After substituting our returns for each component we get “return profits”, π, of

π = Ṗ + rH −Ṗ + ωṖ + rL +ci

= rH − ωṖ + rL + ci.

Therefore, supplying new homes at any point in time increases “return profits” if

rH > ωṖ + rL + ci.

This is a more difficult hurdle than the one under SPT, where price growth did not enter the housing supply problem at all.

But this also tells us that high home price growth reduces the willingness of landowners to convert their land into new housing. Not building now is valuable because it keeps the option open to build a more dense subdivision in the future (either a vertical subdivision in the form of apartments or horizontal in the form of housing lots).

If you feel the urge to imagine a supply curve of sorts, then put the rate of price growth on the y-axis and the supply curve (willingness to supply) is downward sloping.

Many property researchers are now adopting this type of model. For example, in the

model of Alvin Murphy shows that “rising prices make building today more attractive, but also make waiting more attractive, thus reducing the responsiveness to price.”

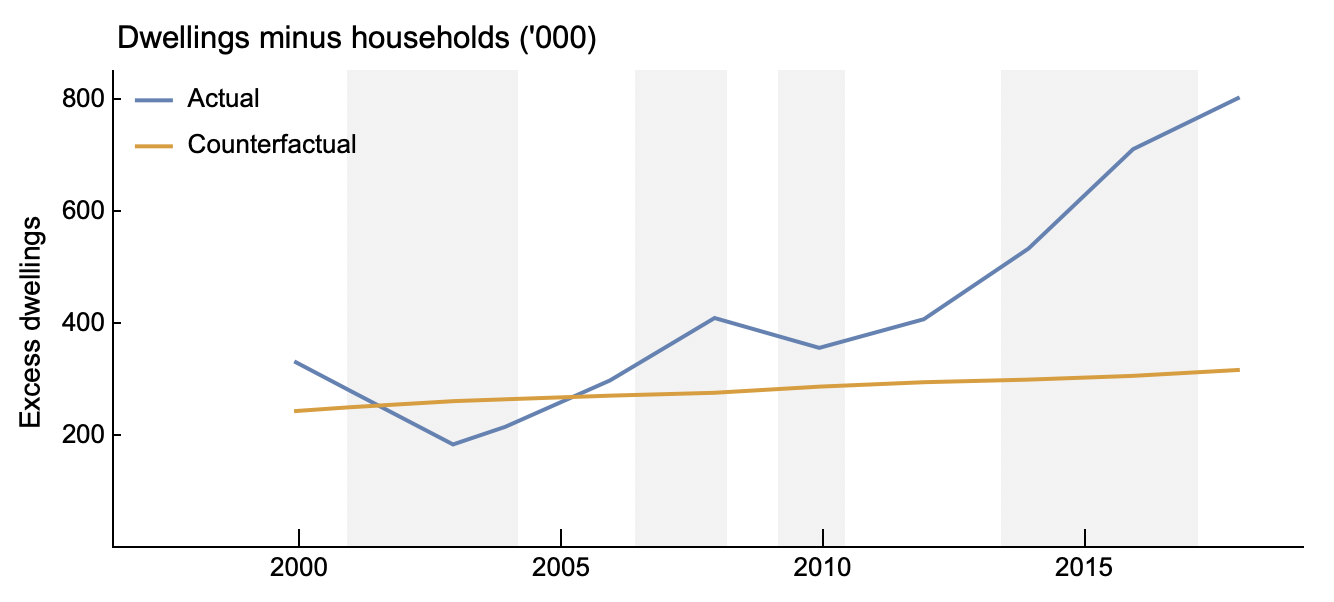

But if rising prices cause less willingness to supply, why are home price booms associated with massive construction booms? The answer to this is quite simple. Not only are landowners and potential housing developers return-maximising, so are all agents in the economy. A little house price growth will attract everyone in the economy to shift away from cash and into housing, new or existing, as this increases their “return profit”.

Since the current owners of the stock of housing have the same incentives to buy and not sell, new housing becomes a the main available investment option for all those willing buyers. But there will always appear to be a shortage of new (or existing) housing for sale. The weight of money that shifts into housing markets both increases home prices and the volume of new home sales. but also decreases the willingness of landowners to sell enough new or existing housing to significantly reduce this price growth.

This BSDT also shows the effect of binding density constraints, which fix ω at zero. This increases the willingness of landowners to supply homes now rather than delay. Instead of planning constraints reducing the total supply of housing as assumed in SPT, they can instead increase the rate of new housing supply.